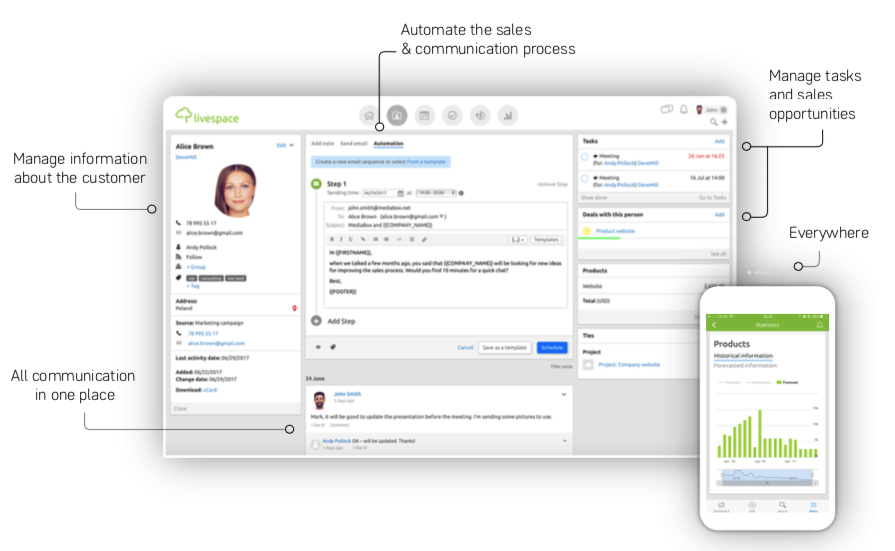

How To Use Nimble CRM For Insurance Agents Upload Customer Data In A Few ClicksĬustomer data can be uploaded to Nimble CRM in several ways, for example: with a spreadsheet or a third-party integration service like Zapier.ĭue to its intuitive interface, this CRM for life insurance agents builds itself for users, once the contacts are in. Why? Reasons are innumerable, so below are just a few major ones: With all of the industry’s challenges, can universal CRM systems that are applicable across the board be successfully used and bring added efficiencies? PWC estimates that technology modernization is still the #1 risk for the global insurance industry. InsurTech has only subsided a few years ago with a $4.15 billion investment in 2018 alone. The industry struggling to fully embrace the power of digital transformation is still in the experimenting stage.

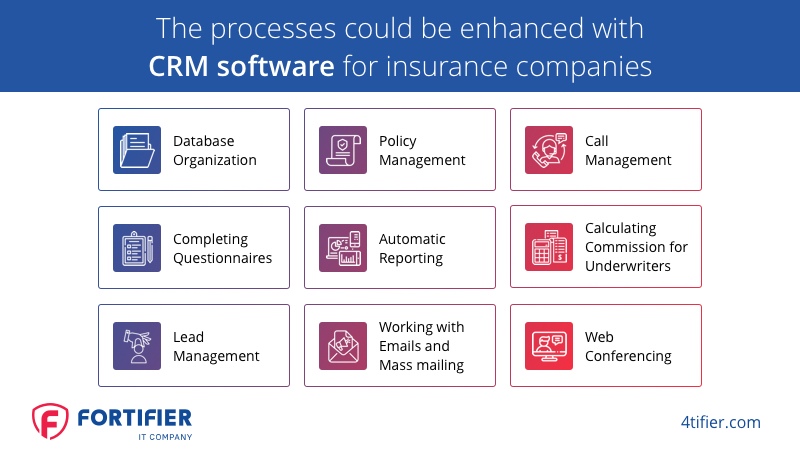

Now that we have reviewed major features & examples of the best insurance software, it is time to review how a universal CRM for insurance agencies fits into this tight tech stack. Insurance Policy software provides an overview for users of the policies at every stage from generation to renewal.Ĭlaims Processing Software: Features & ExamplesĬlaims processing software is designed to optimize claims management.Ĭommercial Insurance Software: Features & ExamplesĬommercial Insurance Software is engineered to systematize the processes pertaining to the realm of commercial insurance policies.Įxamples of Commercial Insurance Software: Insurance Policy Software: Features & Examples Insurance Agency Software is a fusion of Client Relationship Management software and a marketing automation tool with insurance-specific capabilities. Insurance Agency Software: Features & Examples There exist insurance rating software solutions for casualty, health and life insurance.This software is designed to optimize processes related to rate management and policy underwriting. Insurance Rating Software: Features & Examples

Naturally, there is SaaS technology that is universal by design yet is widely used in the industry, for example, insurance CRM software, like Nimble CRM, which we will review later. Let’s review major insurance software categories available on the market now: There is a technology that deals with claim processing and then there is software, that helps to automate policy underwriting, commission management, insurance rating, etc. With the boom of InsurTech, there emerged several solutions for almost every process or role in the insurance realm. Source Categorization Of Insurance Industry-specific Software By Type: Read more on how to use a CRM for insurance agents and a review of industry-specific client management software. We have studied the offer on the market of insurance software solutions so that industry players can make an informed decision. After a decade of experimentation, InsurTech has fallen with peak 212 companies founded in 2016 compared to 14 in 2018. Now, that digital transformation is sweeping through the industry, early adoption of the risk management software became crucial for industry leaders to remain competitive. With almost 6 thousand companies operating on the market. When half of the issues raised in this comprehensive 42-page review are about the digital transformation of the industry, it speaks about the topicality of the technological software solutions in the sphere.Ī massive 2.9% of the USA national GDP is contributed by insurance carriers.

0 kommentar(er)

0 kommentar(er)